Dear Silvers: Can You Accept Your Kids Being DINKWADs?

With rising costs and a slew of concerns about ultra-competitive Singapore, it might be DINKWAD days ahead for the Lion City.

Read our latest stories

With rising costs and a slew of concerns about ultra-competitive Singapore, it might be DINKWAD days ahead for the Lion City.

Learn how our brains keep us from smart investing and find out more about the common investing mistakes caused by psychological biases.

The SKI Club, or the “Spending Kids’ Inheritance” Club is one which retiree Jeffrey Yang is thinking of joining. He weighs the pros and cons.

In this senior’s guide to investing in REITs, SilverStreak explores tips on how to screen REITs should interest rate movements make these financial instruments a worthwhile consideration.

As the Singapore Exchange (SGX) grapples with criticisms that it is shrinking, experts are debating whether in order to revive SGX, sovereign wealth fund GIC should invest Central Providend Fund (CPF) monies in it. Others argue that there could be other ways to look at the issues including studying solutions from Japan.

You’ve worked hard to build up your investment nest egg. How do you ensure that you continue to grow it by placing your money in safe investments for seniors?

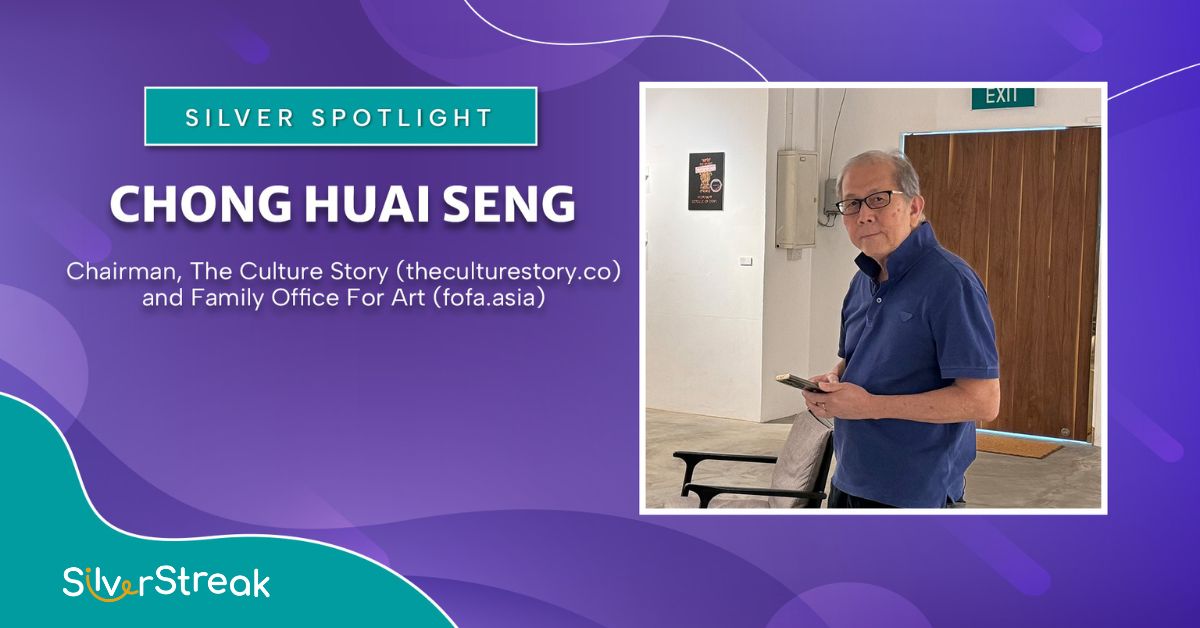

Chong Huai Seng, the founder of the Family Office For Art and The Culture Story has navigated the business world, riding alongside the art world. In this Silver Spotlight interview, he talks about why he left the world of finance and publishing to focus on organising the art collections of people with too little time for it.

How much will you need to live comfortably when you retire? Using your CPF as the basic foundation, SilverStreak gives you the safe and riskier options to decide how much to put away for retirement. [suggest: … decide how much to put away for your retirement income.]

The latest CPF changes about closing the Special Account for those aged 55 from 2025 has generated some unhappiness but brings the fund back to its original intent — for retirement planning.

What will make investors happy? An interest rate cut! From bonds to REITs, R Sivanithy spells out the benefits and how to make the most of them.

Unlike the IPO route, SPACs are “blank-cheque” companies where shareholders take up shares in a SPAC IPO without knowing what business they will be getting into. It’s an investment area to tread very carefully in.

Seniors can expect more help with mid-career switches, an easier time downgrading if they’re single and higher CPF contribution rates late in their career.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |