Need a personal loan at impossibly low interest rates, no strings attached? Or how about a part-time remote job reviewing hotels that pays you $150 an hour?

You might’ve recently received such offers via SMS or messaging applications like WhatsApp or Telegram. These are actually common scams in Singapore, which are getting all the more rampant nowadays.

In fact, almost 60,000 people fell victim to such scams within the past two years, costing them close to $1.3 billion. No trifling sum, especially when we hear terrifying anecdotes of victims who’d seen their retirement savings disappear overnight.

The Government has responded, rolling out an SMS registration scheme for legitimate organisations in a bid to separate their messages from those sent by scammers.

Advertisement

That said, we at SilverStreak felt it pertinent to provide a list of the most common scams currently happening in Singapore — which we will update regularly as new scams emerge — while doling out some tips on how to avoid falling prey to these scams.

The key objective of every scam is tricking you into giving up your personal details, data or hard-earned money by playing on greed or fear.

The most common scams in Singapore right now are (in no particular order):

1. Phishing scam

The phishing scam typically involves an email or SMS that literally ‘fishes’ for your personal information like login details or credit card number.

How the scam works:

- Scammers send you a message dressed up as a reputable institution, often banks, government organisations or e-commerce companies, accompanied by a hyperlink that brings you to a fake version of the institution’s website.

- These messages are tailor-made to cause panic and incur action without a second thought – for example, by informing you of a large fraudulent transaction.

According to the Singapore Police Force, this is the most reported scam type, with over 12,000 cases in the last two years.

2. E-commerce scam

Heard stories of people who’d bought an expensive product online, only to receive something inferior – or nothing at all? They’ve just fallen victim to an e-commerce scam.

How the scam works:

- Limited-edition concert tickets, yet-unreleased gadgets and other rare or luxurious goods are peddled online, often for cheaper than you’d find them on official websites.

- But after making payment, these e-commerce scammers either disappear or demand endless transaction fees and extra delivery charges.

- These scammers often work via social media or fake websites but can just as easily show up on popular marketplaces.

So be sure do your due diligence before purchasing anything online.

3. Investment scam

Investment scammers, pretending to be licensed financial advisors or stockbrokers, offer potential victims an opportunity make big bucks with an ‘investment’ on email or SMS – though of course, they instead make off with your money and personal data.

How the scam works:

- This scam is a tricky one, as not all investments are entirely fabricated.

- They are sometimes based on real-world investment opportunities.

- Some warning signs include unusually high returns, low processing fees, or a shifty company name (which you can check against the Monetary Authority of Singapore’s official list).

That said, it is best to only make investments through trusted advisors on reputable platforms and companies.

This is Singapore’s most costly scam, with victims losing almost $390 million in 2021 and 2022 combined.

4. Love scam

A stranger adds you as a friend on Facebook and strikes up a lovely conversation.

Slowly, you fall in love, and your suitor reveals that they would like to visit you – but they need some cash to book their flight tickets. And train tickets. And some luggage.

Soon, you realise – you have become the victim of a love scam.

How the scam works:

- The love scam is insidious.

- Whether it starts as a WhatsApp message from an unknown number, or a connection over social media, it can take weeks or months to pull off.

- But the reward for scammers is correspondingly greater, as the scammers exploit our need for human connection to squeeze out money again and again. Don’t believe us?

According to the National Crime Prevention Council’s Scam Alert portal, a single victim lost $3 million to this scam.

5. Sextortion scam

A subset of the love scam is the sexstortion scam, where a scammer persuades you into performing an indecent act over a video call (which they secretly record).

Now armed with compromising footage, the scammer proceeds to extort you for money by threatening to send it to your friends and family.

A variation of this scam involves ‘hackers’ claiming that they’ve procured illicit videos and pictures directly from your computer (even if there are none).

How the scam works:

- The scam works by preying on your fears that your reputational standing or relationships might be damaged.

- But these scammers are unlikely to have your personal contact details, so it is best to make a police report and ignore them.

Of course, refraining from filming any indecent acts would also protect you from such scams.

6. Loan scam

A variation of the investment scam that promises a personal loan with attractively low interest rates (and no pesky credit check).

How the scam works:

- Similar to many other scams, the loan scam involves transferring your personal details or some sort of ‘fee’ upfront.

- The former might be used as leverage to threaten you for more money.

Again, only take loans from licensed moneylenders.

7. Fake friend call scam

“Hello, it’s me! Remember me?” is how many fake friend call scams begin, with a mysterious caller pretending to be so chummy that he needs no introduction.

How the scam works:

- Most people would typically start throwing out names of distant acquaintances.

- The scammer might assume the identity of one of these friends, before asking you for a favour.

A simple identity check with specific questions is usually enough to expose them as frauds.

8. Social media impersonation scam

Your online friend drops you a message on Instagram or Facebook, before segueing into asking for money. Except that it’s not your friend, and instead a scammer.

How the scam works:

- There are two modi operandi for the social media impersonation scam.

- Scammers either hack into your friend’s social media account (perhaps after they’ve themselves fallen prey to a phishing scam) or clone their social media profiles entirely, down to the details like an almost identical username and profile photo.

As with other scams, it is important to stop and think twice before giving up any money, even if your ‘friend’ says its urgent. You can also confirm the identity of your friend with a phone call.

Along with the phishing and investment scams, these are the three most common scams involving seniors aged 60 and above.

9. Authority impersonation scam

Another impersonation scam that entails a caller pretending to be, this time, a police officer, court official or staff member at a bank.

How the scam works:

- An authority figure, mixed in with threats and urgency, like a pending arrest warrant for financial crimes that they can clear you of, if only you provide your personal details.

10. Fake job scam

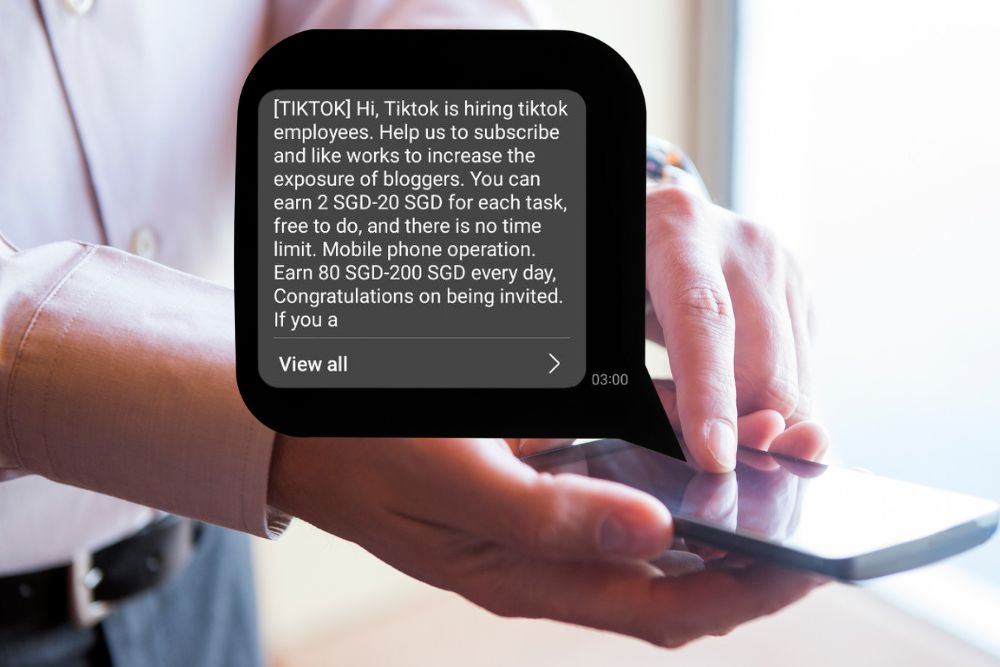

A message comes in, promising highly rewarding work for minimal effort.

Sadly, there is no free lunch, and this is most likely a fake job scam.

Common fake jobs include fully remote ‘roles’ in hotel and restaurant reviewing, affiliate marketing, website testing and so on.

How the scam works:

- Scammers will usually ask you to pony up a ‘processing fee’ to land the job for you.

- In some cases, you will be asked to purchase certain items online as part of the gig, with the promise that any money you spend will be refunded with profits on top.

To make the scam even more convincing, scammers may ‘pay’ you upfront for the item, though these transactions will turn out to be fake or reversed after the fact.