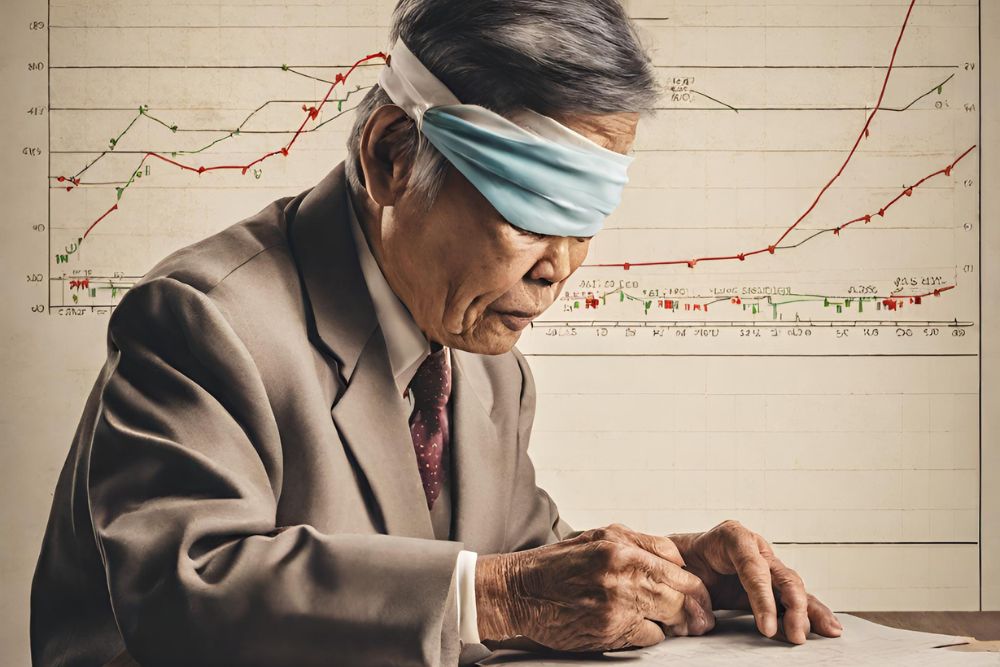

The general advice for silvers looking to invest is to keep it safe. The advanced years and the shortening runway mean there is less room to recover from a strategy that might go south.

That said, if you are confident of the depth of your funds, your future is safeguarded and you enjoy plunging into uncertain waters, then SPACs (Special Purpose Acquisition Company) may be an area to look at with greater interest.

What are SPACs?

It’s best to first understand the nature of SPACs, which are sometimes called “blank cheque” companies because shareholders who take up shares in a SPAC IPO are basically giving money to the company without knowing what business they will be investing in.

This runs counter to the traditional IPO, where a prospectus has to be issued containing details of what the offeror does, its past and projected financials, the risk factors, the key management personnel and how the IPO price was determined.

Advertisement

Instead, SPACs raise money first before going to look for a core business to buy. They are then given 24 months to find a viable business, with a possible 12-month extension.

If they fail to identify a suitable target by the deadline, investors get their money back. However, once a target is identified, a merger with the SPAC or a “de-SPAC” can proceed if more than 50% of independent directors approve the transaction and more than 50% of shareholders vote in support of the transaction.

Shareholders can vote in favour of the merger and still ask for their money back. In VTAC’s case, those who opted to stay invested were offered bonus shares whilst those who opted to redeem their shares were paid S$5.01 per share.

The main advantage of going this route is that it can reduce the time needed for good companies to list – using a SPAC can mean a company can go public in a few months versus at least six months to a year following the normal IPO process.

A word of caution on SPACs

Just take note that many SPAC targets may hold plenty of promise, but many are also not really profitable, at least not yet.

Given that it may take decades for performance to materialise, the advice has to be: tread with caution.

It might have passed unnoticed by some observers, but the first SPAC, Vertex Technology Acquisition Company (VTAC), which listed on the Singapore Exchange (SGX) to much fanfare in January 2022, has suffered a disastrous outing after merging with Taiwanese live-streaming app 17Live in December 2023 – crashing from its initial public offer (IPO) price of S$5 to around S$1.30 in just 6 weeks.

Such a monumental collapse may have raised some eyebrows given that VTAC is sponsored by Temasek-backed venture capital firm Vertex Venture Holdings as few would have expected an entity with such illustrious backing to perform so badly upon listing.

So what went wrong?

Your SPAC investment banks on the sponsor’s ability and connections

SPACs are formed first by “sponsors” or parties that claim to have the expertise to identify future stars (the operative word here is “claim”). These sponsors typically own a stake (about 20%) with the rest owned by the public.

From this discussion, it should be obvious that when investing in a SPAC, the reputation of the sponsor is a crucial consideration because investors are basically banking on the ability of the sponsor to find a good target.

However, equally important are the fundamentals of the target, the acquisition price and future prospects.

So even though in VTAC’s case there was a Temasek-backed sponsor involved, which should have lent some support, it appears this wasn’t sufficient as the market has doubts over 17Live’s prospects as well as the price paid.

What happened with Singapore’s first SPAC, VTAC?

In its IPO prospectus, VTAC stated that its aim was to identify a high-growth company with deep domain expertise in areas including consumer Internet and technologies. The company would have to be at an inflection point in its growth journey and ready to undertake an IPO.

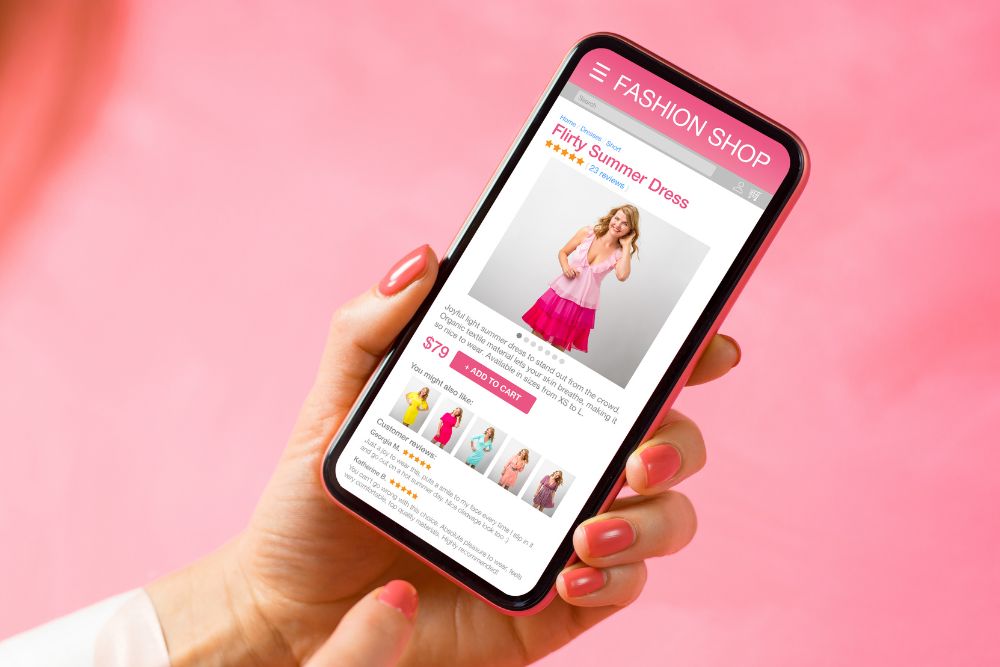

Live-streaming app 17Live was selected from Vertex’s portfolio of more than 300 companies. It owns the technology behind an Internet platform where aspiring individuals can sing, experiment with make-up and fashion, cook or play games, among other things, while interacting with their followers in real time.

One reason 17Live is viewed as unique is that it allows viewers to be engaged by and form emotional connections with their favourite streamers over the Internet. It enables communities to form among like-minded individuals and provides a convenient and affordable avenue of entertainment for a diverse user base.

17Live is said to be the No.1 amongst similiar platforms in Japan and Taiwan, where live streaming is a growing business and part of the popular culture.

The app makes most of its money when viewers purchase virtual gifts for their preferred streamers in the app. The streamers then sell these virtual gifts back to the platform under a revenue-sharing model and based on a mutually agreed upon ratio.

For the first half of 2023, revenues totalled US$151 million (S$202 million), down by around 25% from US$200.4 million during the same period a year ago. The company posted a loss of US$118.2 million for the first half compared to US$42 million a year earlier.

However, after adjusting for the revaluation of its preferred shares and warrants, it recorded a profit of US$9.4 million. At the operating level, profit stood at US$15.8 million, up from US$4.3 million the year before.

What analysts said about the SPAC

After the merger with 17Live was announced, research house Phillip Securities, in a Nov 20 report, placed a fair value of between US$581 million and US$700 million on the firm.

In comparison, VTAC proposed to acquire 17Live for $800.8 million through the issuance of 162 million new shares. If certain targets were met, the potential acquisition value would rise to a maximum of $922.9 million, or about US$691 million.

Meanwhile, popular investment advisory website Beansprout said it valued a 100% equity stake in 17LIVEat US$460 million (S$622 million), well below the purchase consideration of up to S$922.9 million.

In short, it looks very much like VTAC overpaid for a company with muted near-term prospects and the market knew this. Phillip’s recommendation was for shareholders to vote in favour of the merger but to also fully redeem their shares. (The word “fully’’ here is used because partial redemption was also allowed).

Meanwhile, Beansprout also recommended shareholders opt for full redemption.

How have SPACs performed in other countries?

In general, the majority of post-merger SPACs have performed poorly in recent years.

According to investment management firm Russell Investments in an April 2023 report, the De-SPAC Index, which measures the performance of companies taken public through a SPAC merger, fell by 75% in 2022, after losing 45% in 2021.

Singapore’s Grab Holdings listed on Nasdaq in December 2021 via a SPAC known as Altimeter Growth Corp. Prior to the merger with Grab, Altimeter’s shares traded for around US$13.

As of 31 Jan 2024, the shares trade at US$3.22, so Grab has also vastly underperformed since listing. For the quarter ended 30 Sep 2023, Grab reported a loss of US$99m, albeit an improvement from the US$342m loss a year earlier.

The risks of SPAC investing

"Several of the features that make SPACs attractive led to over-crowding in the space and subsequent disappointing performance. The looseness of financial disclosures and growth projections led to a number of high-profile electric vehicle companies brought public via SPACs to overpromise and underdeliver. Many companies have missed their forecasts and restated their financials, and some have even gone bankrupt’’ said Russell, adding that in 2022, the average redemption increased significantly since the bull market of 2021, “with over 90% of investors voting no on proposed deals".

The economic structure of a SPAC creates an inherent conflict between a SPAC’s sponsor and its public shareholders. That conflict arises because the only decision a SPAC’s management must make is to either merge or liquidate. If a suitable target is identified, the sponsor would be keen for the SPAC to enter into a merger that is value-increasing for all shareholders, but the sponsor will nonetheless make money even in a merger that is a losing proposition for the SPAC’s public shareholders.

Furthermore, note that the Singapore Institute of Directors, in its Q3 2023 Bulletin on SPACs stated:

What does the future hold for SPACs on SGX?

SPACs aim to find promising tech disruptors or “new economy” superstars, but investors have to ask themselves how many of such gems there are waiting to be unearthed, given that thousands of SPACs have already been listed in the US and Europe over the past decade.

Investors should note that the only two other SPACs to list here to date, Pegasus Asia and Novo Tellus Alpha Acquisition, have announced their intention to dissolve and return money to shareholders, probably taking their cue from 17Live’s dismal post-listing performance.

The bottom line? SPACs are a new and novel means of capital raising which SGX, in its desire to remain on par with fresh initiatives in other developed markets, was correct in introducing here.

But it could well be that SGX has been too late into getting into the SPAC game, as all the best money to be made has already been made elsewhere.