At different stages in your life, you have to adopt a different approach to investing.

In your 20s and 30s, you are accumulating wealth and can take more risks with your money — provided of course, your risk profile allows you to do so.

However, as we age and our investment horizons shorten, it is advisable to gradually shift our investments away from those that are higher-risk because time to earn back losses and sit out volatility is running out.

A person in their 40s and 50s can be said to be in their pre-retirement phase, when they should seriously start thinking about retirement.

The investment objective here should therefore shift from Growth to Income, which means moving some money into safer, income-generating assets whilst reducing the amount of overall risk in the portfolio.

Advertisement

Once you reach your 60s onwards, you are in the retirement phase of your life, when you ideally reap the rewards of all your hard work over the past 40-odd years.

Since you may not have an active income-generating job now, your accumulated retirement nest egg will serve the purpose of generating the required income for you.

At this stage, the investment objective should shift to Security, which means focusing on keeping your savings secure.

At this stage, you don’t want to take too much risk with your capital, so your money should be invested in very safe instruments that may offer only modest returns but come with very little or no risk.

One of the ironies of investing

Before proceeding, a few words of caution. Younger people generally have less money to invest because their incomes tend to be modest.

Older people on the other hand, will have a lot more disposable funds – many for example, may have insurance policies that have paid out after 20-30 years and they are also able to withdraw CPF funds at age 55 after setting aside the appropriate amount in their Retirement Account.

With a large sum on hand, the temptation is strong to try and grow this money as quickly as possible – recall for example, how many retirees lost their nest eggs in the 1990s when Malaysian shares traded on a hugely speculative segment of the local market known as Clob International all crashed in 1998 when the Malaysian government declared Clob to be an illegal market at the height of the Asian financial crisis.

Also, some 34,000 investors, many of whom were retirees, have lost whatever money they put in the perpetuals issued by failed water treatment firm Hyflux, most likely because they were attracted to the headline return of 6% and failed to read all the risk disclosures.

This is the irony of investing – younger people are able take on more risk, but they don’t, older people can’t afford to take on too much risk but they do. Make sure you don’t fall into this trap.

Investing between the age of 50-55

If you fall in this age group, you are likely to be well-established in your career. In this phase your earning capacity is probably at its maximum, though your financial demands can be diverse – you may have elderly parents to look after, as well as children who may be of university-going age.

Hopefully, you are almost about to finish repaying your housing loan and your insurance needs have been catered for because it’s always advisable to buy adequate insurance when you are young and relatively free from major medical conditions.

As a guide, note that the Life Insurance Association of Singapore recommends having about 10 times your annual income as life cover, and about 3.9 times annual income as health insurance cover.

Those unsure of how much life insurance they should have can use the CPF Insurance Estimator on CPF’s website.

Hopefully, someone in this age group has an idea of how much he or she needs in retirement income having already started their investment planning early.

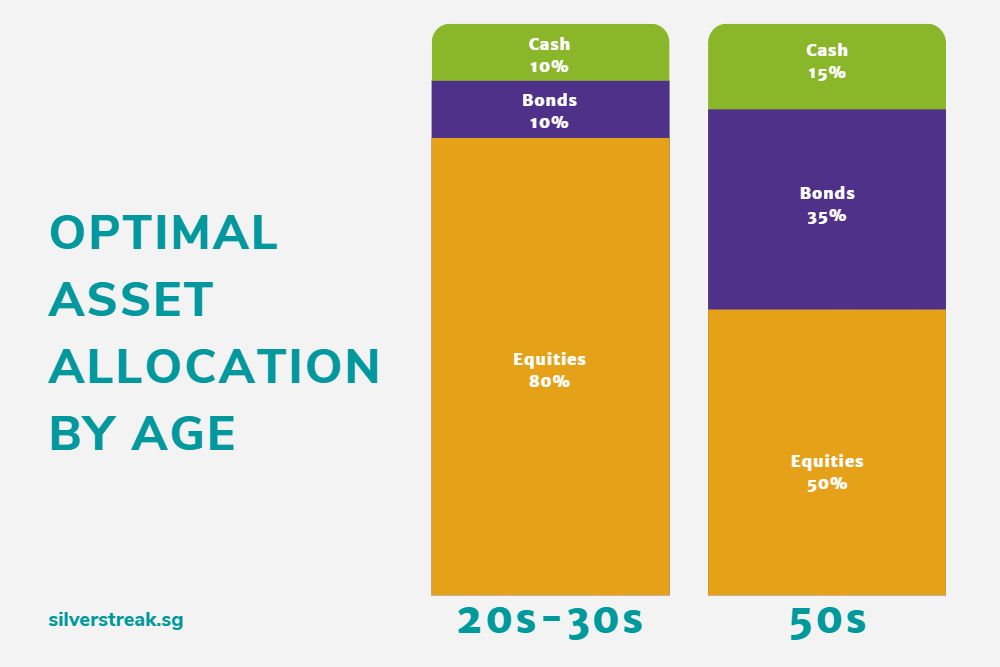

Compared to a person in their 20s and 30s whose optimal asset allocation might be 80% equities, 10% bonds and 10% cash, a person in their 50s should consider rebalancing his or her portfolio to 50% equities, 35% bonds and 15% cash.

The equities could be those which come with moderate risk, possibly a mix of dividend-paying blue chips and medium capitalisation companies in defensive industries like food, utilities and healthcare.

How many stocks to own is a difficult question to answer — studies have shown that in order to enjoy the full benefits of diversification, individuals should ideally own around 20 stocks but tracking this many can be difficult for some.

Contained within the equity component could be Real Estate Investment Trusts, which are basically property landlords that collect rent from their tenants and distribute the money to shareholders.

REITs in Singapore can realistically be expected to deliver annual returns of 4-7% – not fantastic but decent enough for the associated risk.

As for the bonds, it’s best to stick to investment-grade bonds that are Triple-A rated by ratings agencies like Moody or Standard & Poor’s.

Investing between the age of 50-55

At this life stage, your housing loan should have been fully repaid and your thoughts should really turn towards retirement.

This doesn’t just refer to retirement income but also how you are going to occupy yourself once you stop work – hobbies you might wish to pursue, part-time employment, travel, etc.

This consideration is just as important as thinking about the money side of things as studies have shown that many people suffer a steep decline in mental and physical health in retirement.

As mentioned earlier, some individuals might choose to withdraw their CPF savings at age 55 once their Retirement Accounts have been set up.

However, do so only if you really need the money, or if you think you are able to invest the money and earn better returns than the prevailing CPF base rates of 2.5% for savings in the Ordinary Account savings and 4% for the Special Account.

In line with suggestions made earlier, the shift towards lower-risk investment should continue, with a suggested portfolio of 25% equities, 55% bonds and 20% cash.

Investing from age 60 onwards

A person in this age is likely to be retired. Hopefully he or she has adequate CPF savings and if they have set aside the Full Retirement Sum when they turned 55, then they can at least enjoy the lifelong payment of around S$1,500 per month under the CPF LIFE Standard Plan at age 65.

Hopefully also, he or she had also planned for their retirement early and can therefore supplement this payout with funds from their investments.

This stage is sometimes called the start of the “decumulation phase” of your life, when you start to draw down on the assets you have accumulated.

One approach to investing at this life stage is to separate investments into buckets.

The first bucket will comprise a few years of income in zero- or near-zero risk savings to be used for immediate needs. This could be fixed deposits, Government-issued T-bills or the Singapore Savings Bonds.

The second bucket will have a higher proportion of fixed income instruments that provide regular interest payments and mature in 7 or 10 years, and then a longer-term bucket with riskier and more volatile investments that may not perform now but have the potential to deliver later, after 10 years.

The first bucket should comprise a larger proportion of your portfolio, whilst the third should have the smallest.

Women: Bear in mind your higher longevity

According to the Department of Statistics, the average Singaporean life expectancy in 2022 was 83.5 years versus 78.55 years twenty years earlier in 2002.

On average, males can be expected to live until 81.1 years whilst females until 85.9 years, or about an additional 4-5 years.

This means there is greater importance for women to invest early in order to ensure sufficient income in retirement.

The good news is that studies have shown that women, on average, tend to make better investors than men.

For instance, women spend more time researching their investment choices. And while they do take on less risk than men when it comes to investing, that doesn’t mean they are risk averse.

Rather, they are simply more likely to take on appropriate levels of risk with their investments than men. Both of these findings make for better investing outcomes.

The bad news, however, is that surveys show that in a typical household (not just in Asia but also in Western countries), the division typically goes like this – women are in charge of the household budget, while men take decisions related to investments and big purchases.

So even though research suggests that women investors tend to outperform men, most families leave the investing decisions to the male.

A note on risk and return

It is one of the most basic rules of the financial world that if you desire higher returns, you have to be prepared for more risk.

However, many investors, including those who might be classified as sophisticated, fail to understand this, perhaps allowing greed to cloud their judgement.

For example, an alleged billion-dollar commodities scam involving a firm known as Envy Global Trading a couple of years ago has seen a bunch of high-net worth individuals, including a well-known fund manager and prominent lawyers (such as a former President of the Law Society and Temasek’s general counsel) lose large sums of money after being promised a mouth-watering return of 15% every three months.

When you really think about it, this works out to a guaranteed 60% per annum, which is astonishingly high and should have raised major alarm bells purely from the risk viewpoint, never mind that the authorities are now prosecuting the founder of Envy Global for fraud.

Again, if you are an older person, the lesson here is not chase fantastic returns like this because chances are very high that there is a catch. Be realistic with expected returns, understand what you are buying and read all the relevant documents.