1. Maximise the interest earned on balances from the different CPF accounts

There are four:

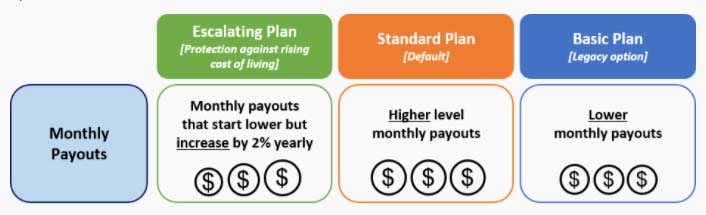

2. Choose CPF LIFE plans to suit your needs

Learn more about the CPF LIFE Scheme.

3. Find a Scheme that Works for You

Matched Retirement Scheme

If you’ve yet to meet the current Basic Retirement Sum, you can save more with this scheme. Between 2021 and 2025, if you top up your CPF Retirement Account via the Retirement Sum Top-Up Scheme (RSTU), the government will match it dollar-for-dollar up to $600 a year. Check your eligibility here.

Supplementary Retirement Scheme (SRS)

If you haven’t already done this, save for retirement with the SRS because all contributions are eligible for tax relief. The investment returns are accumulated tax-free (except for Singapore dividends) and only 50% of the withdrawals from the SRS are taxable at retirement. Learn more about the SRS here.

4. Top up your SA and gain tax relief

It takes just a little bit of time to work all this out, and the staff on the CPF hotline are patient and helpful. Call 1800-2271188 from Mondays to Fridays 8.00am to 5.30pm for assistance.